Depreciation estimate house

But businesses may also estimate a higher salvage value. Must contain at least 4 different symbols.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

In May 1986 you acquired and placed in service a house that qualified as low-income rental housing under item 3 of the above listing.

. The actual cash value is the value of an appliance after considering depreciation due to wear and tear. To calculate the depreciation of building component take out the ratio of years of construction and total age of the building. A new house purchased for 730000.

After calling BMT Tax Depreciation Michael found he could claim 15500 in depreciation deductions in the first full financial year. To calculate the car depreciation rate use the Commissioners estimate or self-assess the effective life of the vehicle. The average five-year depreciation rate of vehicles in the US.

Whether it is a company vehicle goodwill corporate headquarters or a. No matter how you. From 1 July 2015 the statutory effective life of in-house software is 5 years from 13 May 2008 the effective life is 4 years a rate of 25 pa.

ASCII characters only characters found on a standard US keyboard. House depreciation is the cost deduction process used when buying or improving rental properties. Talk to a depreciation specialist on 1300 728 726.

At the time it was estimated to bring in 124 billion over the next 10 years. Dont pay for a property depreciation estimate. The useful life of a piece of property is an estimate of how long you can expect to use it in your trade or business or to produce income.

Most real estate agents and brokers receive income in the form of commissions from sales transactions. The Years to Hold whichever number of years you choose is considered the year that the property would be sold. Alternatively you can calculate the.

In my opinion the best ones are free. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. A new house purchased for 730000.

Section 179 deduction dollar limits. Get 247 customer support help when you place a homework help service order with us. The BMT Construction Cost Table is a useful guide to the cost of building a house as well as a variety of building types including townhouses residential apartments office blocks industrial warehouses supermarkets shopping centres hotels and motels.

In house software is given a statutory effective life as the basis of depreciation claims. Is around 502 percent of their. This car depreciation calculator is a handy tool that will help you estimate the value of your car once its.

A depreciation calculator is merely an accounting tool that helps investors save money by claiming the wear and tear of a property on their tax return. This could either be for book-keeping records following the depreciation expense period or because a company wants to sell the assets remaining value. The actual cash value is the difference between the replacement cost and the depreciation cost.

This Is What Happens When The Market Value Of A Property Falls How to calculate depreciation of property. The limit is updated every year. Some companies estimate an assets salvage value to be 0 by the end of its term.

When a company acquires an asset that asset may have a long useful life. There is a car depreciation limit when calculating the depreciation cost of a work-related car. Build your referral base and keep your clients coming back with BMT.

Youre generally not considered an employee under federal tax guidelines but rather a self-employed sole proprietor even if youre an agent or broker working for a real estate brokerage firm. This is also a reason why many people take loans to buy a car or decide to lease them. It is the length of time over which you.

If you elect not to claim a special depreciation allowance for a vehicle placed in service in 2021 the amount increases to 10200. You can use the fair market value of each at the time you acquired the property to estimate the value. Through timely in-depth analysis of companies industries markets and world economies Morgan Stanley has earned its reputation as a leader in the field of investment research.

Each property is different and many factors must be considered when preparing a property depreciation schedule. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Whether to Flip a House or Use Buy-and-Hold.

There are several depreciation calculators on the market many of which can be found easily through a Google search for depreciation calculator. Before you buy estimate your costs and expenses as well as your rental income. The first-year limit on depreciation special depreciation allowance and section 179 deduction for vehicles acquired after September 27 2017 and placed in service during 2021 increases to 18200.

After calling BMT Tax Depreciation Michael found he could claim 15500 in depreciation deductions in the first full financial year. As BMT Tax Depreciation are one of the only recognised professions with the appropriate construction costing skills to estimate construction costs for depreciation purposes. But you can deduct or subtract your rental expensesthe money you spent in your role as the person renting out the propertyfrom that rental income reducing your tax obligation.

To learn more about the depreciation calculator or to request a personalised depreciation estimate contact us today. A new house purchased for 730000. 6 to 30 characters long.

For an independent house the average lifespan of any building is 60 years. Monthly Rent Enter or estimate the amount of monthly rent you can get for your property. Input values in the calculator on the left to get a quick read on the financial viability of renting or selling your house.

When you rent property to others you must report the rent as income on your taxes. The effective life estimate depends on the type of vehicle and how it was used. This self-employed status allows you to deduct many of the.

The Washington Brown a property depreciation calculator is unique because it enables property investors to estimate the depreciation by simply inputting a purchase price. House Democrats included a 1 percent buyback tax in their 22 trillion reconciliation package passed last year. Depreciation Recapture for Rental Properties.

After calling BMT Tax Depreciation Michael found he could claim 15500 in depreciation deductions in the first full financial year. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. How Rental Property Depreciation Works.

Effectively you can lower your tax liability by deducting expenses from your earned rental income. The replacement cash value is the current cost of the product in the market ie the cost required to replace the item you own with a new one at present. Attract investors with a tax depreciation estimate.

Many expenses can be deducted in the year you spend the money but depreciation is different.

How Is Property Depreciation Calculated Rent Blog

Depreciation And Off The Plan Properties Bmt Insider

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Download Depreciation Calculator Excel Template Exceldatapro

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Rental Property Depreciation Rules Schedule Recapture

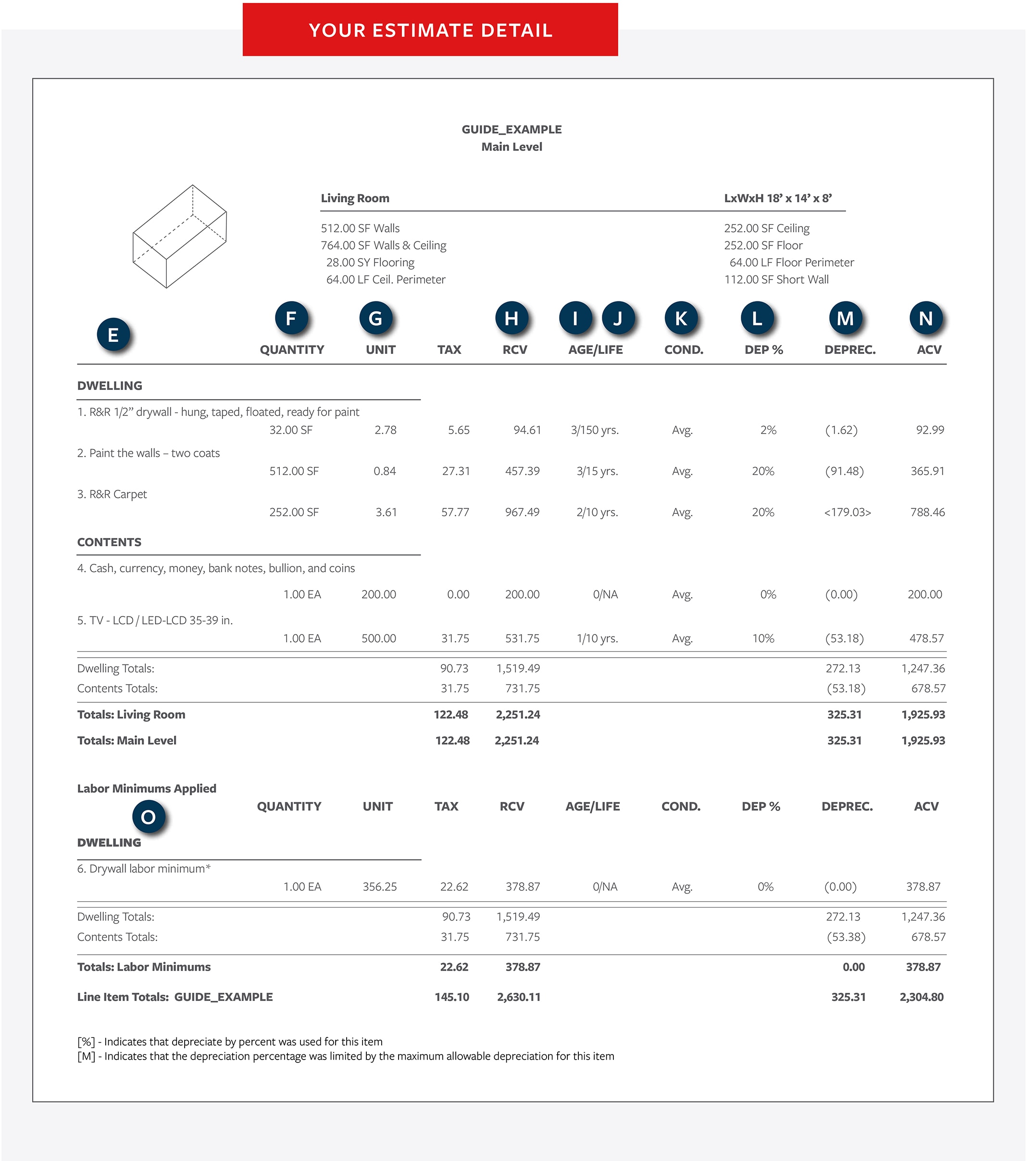

Understanding Your Property Estimate Travelers Insurance

How To Use Rental Property Depreciation To Your Advantage

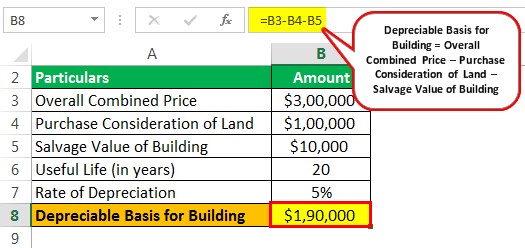

Depreciation Of Building Definition Examples How To Calculate

How To Calculate Depreciation Expense For Business

Rental Property Depreciation Rules Schedule Recapture

Depreciation Of Building Definition Examples How To Calculate

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

How Depreciation Claiming Boosts Property Cash Flow

How To Calculate Property Depreciation

A Guide To Property Depreciation And How Much You Can Save

Depreciation Schedule Formula And Calculator